Moli General Terms of Use

Frequently asked questions

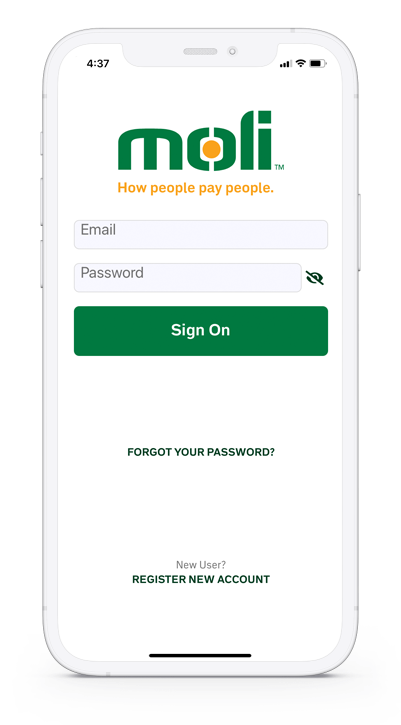

Moli is available through many banks and credit unions throughout the U.S. If you want Moli ask your bank or credit union if they offer it. The app can be downloaded from Google Play for Android users and the App Store for Apple users.

If you are using a debit card, the money will be in your friends account within minutes. If you are using a checking account money will be in your friends account, the same day or the next business day.

Not necessarily! All your friend needs is an active checking account or debit card, but a Moli account is definitely recommended.

That can be done in the Menu section of the Moli app under your profile information.

In order to use Moli, the sender and recipient’s banking accounts must be based in the U.S.

Not yet, but it’s coming soon so keep checking back!

It's simple. There is a "Delete Me" link located on the profile page. If you need additional help, contact your bank or credit union.

Contact your bank or credit union. They can help.

Each email address registered with Moli must be unique. Be sure the email address you are using isn’t shared with anyone else or that you haven’t already registered.

Contact your bank or credit union.

No, not yet. Currently, Moli only links to bank and credit union accounts and debit cards. But there are plans to allow credit cards in the future.

No, you cannot cancel a payment. You should treat every Moli transaction like you would cash. Once the payment has been made, it's final. If you have further questions about this, contact your bank or credit union.

The short answer is yes, for your security and protection there are limits set on how much money can be sent. The limits are set by your bank or credit union and can be conveniently viewed and tracked in the Moli app.

Yes. Since the Moli app is being offered through your bank or credit union and the Visa/Mastercard networks, it is backed with some of the best end-to-end encryption available including an added layer of security through 3D Secure (3DS) technology.

Moli does not hold your money. It transfers money from one account to another without it being held in the middle. Moli is provided by your trusted financial institution. Your bank or credit union will keep your personal information safe and your money secure. Your data is never shared and your money stays in your checking account with your bank or credit union.

Yes. The great thing about Moli is the money is available and ready to be used in your checking account.

You have to be 18 years or older to use the app.

Please contact your bank or credit union for any additional assistance specific to app enrollment and troubleshooting.

No. Moli automatically puts the money in your checking account. See, easy peasy.